|

| Creighton University chart compares this month to last month and year ago; click here to download it and chart below. |

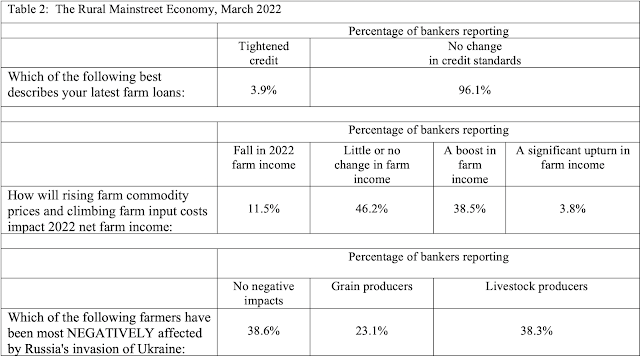

Rural bankers in 10 Midwestern states that rely on agriculture and energy saw the 16th straight month of positive economic growth in a monthly survey in March, despite concerns about increased production costs and the Russian invasion of Ukraine. The Rural Mainstreet Index polls bankers in about 200 rural places averaging 1,300 population in Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming.

"A 25 percent gain in farm commodity prices over the past 12 months, near-record-low short-term interest rates and growing agricultural exports have underpinned the Rural Mainstreet Economy," writes Creighton University economist Ernie Goss, who compiles the index.

The overall index for March rose to 65.4 from last month's 61.5; anything over 50 is growth-positive. Though retail sales dipped to 51.9 from February's 57.7, indexes for home sales and bank loan volume increased sharply, and farmland prices, farm equipment sales, and checking deposits remained strong. And, the confidence index, which measures how healthy they believe the economy will be in six months, ticked upward to 54 from February's 51.9.

No comments:

Post a Comment