|

| Some mines owned by Lexington Coal (Bloomberg) |

Facing bankruptcy and looking to avoid the cost of mine cleanup, larger coal companies offload older mines in need of reclamation onto smaller companies with little resources,

reports an investigation by

Bloomberg and

NPR. Those smaller companies often can't foot the bill for reclaiming the old mine land, "raising the risk that taxpayers, rather than industry, will eventually be stuck with the cost."

The unreclaimed mines are also hazards to the environment and local communities. A man who lived near the Love Branch mine near the Kentucky border with West Virginia told the news organizations that red water running off from the mine flooded his property, causing him to fall through his floor and ruining his septic system. Lexington Coal Co., the company that owns the mine some in West Virginia, has the second-most violations of any coal operator in the country this year. Lexington acquired the mines from Alpha Metallurgical Resources, one of the largest coal companies in the U.S.

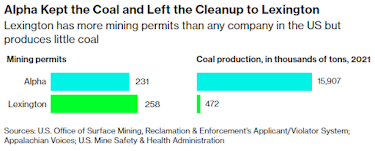

Since 2015, when an industry-wide downturn pushed Alpha and other large coal companies into bankruptcy, the company has transferred more than 300 mining permits to smaller companies like Lexington. It also shed its pension and health-care obligations, went through bankruptcy, and saw its share price increase over 700% since 2016, Bloomberg and NPR report.

|

| Bloomberg graph |

Of the 232 mostly idle mining permits that Alpha transferred to Lexington Coal, only 41 have been cleaned up, the investigation found. The company has also only authorized the release of about 13% of the reclamation bonding needed to pay for restoring the mines.

No comments:

Post a Comment