|

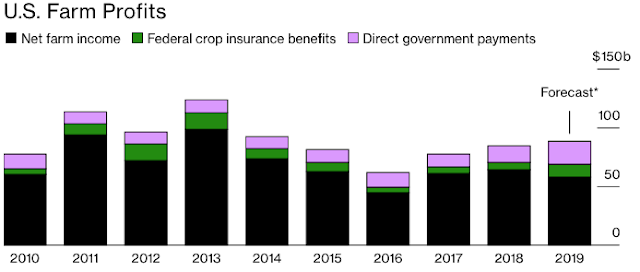

| Lavender segments in U.S. Department of Agriculture chart show government payments to farmers. |

Farmers' feelings about that range from complacent to uneasy to frustrated. One in the middle is Illinois soybean farmer Stan Born, who told Bloomberg: "The aid package that has come in is a relief, and it softens the landing, but it’s not a solution, it’s a Band-Aid." When reporters asked him if the trade relief made him whole, he said "Of course not," and said he'd rather have free trade.

Trump has been able to fund the bailout without action in Congress, by using the Depression-era Commodity Credit Corp., but action is likely to be needed because the CCC is expected to reach its $30 billion borrowing limit before the second round of payments are completed, Jeff Stein and Mike DeBonis of The Washington Post reported last week.

The trade war "is being waged primarily for the benefit of such sectors as manufacturing and tech," Parker and Dorning note. "Agriculture is actually one of the rare U.S. industries that consistently runs a trade surplus, and not just with China—testimony to the gains that have accrued to American farmers from globalization."

Farmers' global success is the main reason many are at a disadvantage now. Until the trade war, China was the nation's biggest soybean customer (exceeding $12 billion in 2017), and a major purchaser of many other farm products like pork, Bloomberg notes. Though China has made a few soybean buys as goodwill gestures during trade talks, some this week, it's not buying anywhere near what it used to.

No comments:

Post a Comment