|

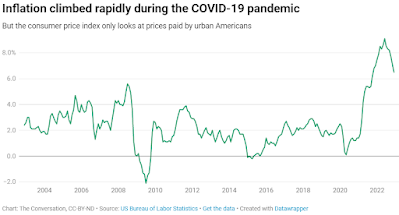

| Data from Bureau of Labor Statistics; chart by The Conversation (click it to enlarge) |

"We believe this poses a problem," Weiler and Conroy write. "People living outside America’s cities represent 14% of the U.S. population, or around 46 million people. They are likely to face different financial pressures and have different consumption habits than urbanites. . . . it may even be masking a rural-urban inflation gap." Weiler and Conroy did their own rural-urban inflation gap research, which outlined some distinctive differences:

Vehicle expenses: "Car ownership is integral to rural life, essential for getting from place to place . . . Urban residents can more easily choose cheaper options like public transit, walking or bicycling. This has several implications for expenses in rural areas. . . . Longer journeys mean cars and trucks will wear out more quickly. As a result, rural residents have to devote more money to repairing and replacing cars and trucks. . . . Periods of high energy prices, such as the one the U.S. experienced through much of 2022, are likely to disproportionately affect rural residents given the necessity and greater distances of driving."

Food security: "Rural residents already spend a larger amount on eating at home, likely due in part to the slimmer choices available for eating out. This means they have less flexibility as food costs rise, particularly when it comes to essential grocery items for home preparation. And with the annual inflation of the price of groceries outpacing the cost eating out – 11.8% versus 8.3% – dining at home becomes comparably more expensive. . . . Rural Americans also do more driving to get groceries; the median rural household travels 3.11 miles to go to the nearest grocery store, compared with 0.69 miles for city dwellers."

Health care: Rural residents trend older, "and older people spend more on health insurance and medical services. Medical services overall have been rising in cost too, so those older populations will be spending more for vital doctors visits. . . . On average, rural Americans travel 5 more miles to get to the nearest hospital than those living in cities. And specialists may be hundreds of miles away."

Home energy costs: "Poorer-quality housing leaves rural homeowners and renters vulnerable to rising heating and cooling costs, as well as additional maintenance costs."

Weiler and Conroy note, "While there is no conclusive official quantitative data that shows an urban-rural inflation gap, a review of rural life and consumption habits suggests that rural Americans suffer more as the cost of living goes up. . . . rural inflation may be more pernicious than urban inflation, with price increases likely lingering longer than in cities."

No comments:

Post a Comment