|

| Bloomberg graph, adapted by The Rural Blog |

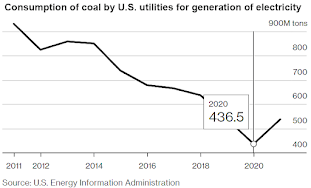

"U.S. power plants are on track to burn 23% more coal this year, the first increase since 2013, despite Biden’s ambitious plan to eliminate carbon emissions from the power grid. The rebound comes after consumption by utilities plunged 36% under Trump, who slashed environmental regulations in an unsuccessful effort to boost the fuel," Wade reports.

"The boom is being driven by surging natural gas prices and a global energy crisis that’s forcing countries to burn dirtier fuels to keep up with demand. It’s also a stark reminder that government policy can steer energy markets, but it can’t control them. . . . As the world emerges from the coronavirus pandemic, reopening economies are driving a huge rebound for power demand. But natural gas is in short supply, creating shortfalls at a time when wind and hydro have been unreliable in some regions."

Central Appalachia, the major coal region that has been hurt most by the decade of downturn under Trump and Barack Obama, the most anti-coal president ever, has benefited most from the rebound. Coal prices there have risen 39% since Jan. 1 to $75.50 a ton, the highest since May 2019, Wade reports: "Prices in other regions are lower, but also on the rise."

Coal is a boom-and-bust business, but the trend is expected to continue, due to market forces and forecasts of a colder-than-usual winter. "Demand for coal will likely remain strong into next year, said Ernie Thrasher, CEO of Xcoal Energy & Resources, the biggest U.S. exporter of the fuel," Wade reports. "Supply is already constrained, and Thrasher said he’s hearing some utilities express concern that they may face fuel shortages over the next several months as colder weather pushes energy demand higher to heat homes."

No comments:

Post a Comment